The desire to quickly become a millionaire has been a basic desire since the birth of money. From Tulips to Slerf, there is no shortage of investments that promise to make you rich overnight. However, there may be a more effective investment strategy that considers risk and reward.

Timing plays a key role in investment decisions, but achieving precision in this aspect can be quite difficult. A more conservative approach has proven to be one of the most effective investing strategies: dollar-cost averaging (DCA).

DCA involves regularly purchasing a fixed dollar amount of an asset over time. This strategy aims to reduce volatility by spreading out buy orders. This approach allows some purchases to be made at lower prices and others at higher prices, making it attractive for highly volatile assets, such as Bitcoin (BTC).

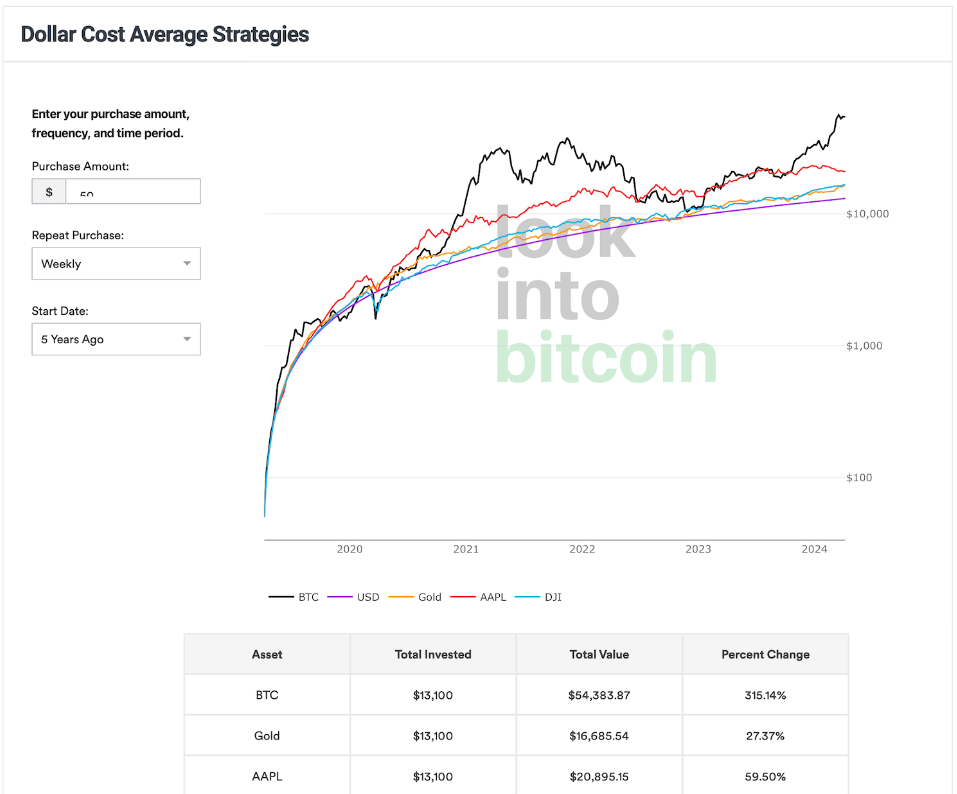

DCA into Bitcoin generates outsized returns

Investing $50 weekly or $200 monthly in Bitcoin from July 2019 would have yielded significant returns of 345.9% by January 2024. With a total initial investment of just over $13,000, the total value reached was $58,193.

In contrast, investing in gold over the same period would have returned a modest 24.9%, while the Dow Jones Industrial Average (DJI) has not increased by even 1%.

Meanwhile, Apple stock saw a notable gain of 64.4% over the same time frame, with the DCA strategy’s total value reaching $21,400.

However, it is important to note that Bitcoin’s volatility is significantly higher than traditional assets. For example, from 2020 to 2021, Bitcoin’s closing price increased by $46,387 on December 31, 2021, marking a staggering 543.1% increase.

However, this rapid increase was accompanied by a sharp decline of more than 65% from November 2021 to November 2022, highlighting the extreme volatility inherent in the cryptocurrency market.

The unpredictable nature of rallies, coupled with Bitcoin’s inherent volatility, can make it difficult for investors to maintain their positions for any length of time. While DCA can be effective, it depends heavily on the investor’s confidence in the chosen asset.

DCA is an easy way to accumulate BTC

Dollar-cost averaging can be a great fit for new investors looking to diversify their portfolio into cryptocurrencies. By investing a fixed amount, such as $50, weekly, regardless of market conditions, investors can effectively spread their purchases over time.

This strategy helps minimize the impact of price fluctuations, allowing investors to benefit from the long-term growth potential of the asset. In a recent statement, Daniel Masters, president at CoinShares said:

“With year-to-date volatility at 75% or more, we know BTC’s price path will see many short-term highs and lows. A dollar-cost averaging strategy is an easy way to accumulate positions, while avoiding concentrating too much risk at one time.”

For new investors looking to enter the world of investing, DCA offers a simple and straightforward approach. Instead of trying to analyze the market and make large one-time investments (which can be difficult and risky), DCA allows investors to build their positions steadily over time. .

The optimal BTC investment strategy depends largely on an investor’s risk tolerance, but DCA could be a good way to accumulate BTC during the next bull market.